Master Financial Goal Setting

Transform your relationship with money through our comprehensive 12-week program. Learn practical strategies that successful people use to build lasting wealth and achieve their financial dreams.

Start Your JourneyWhy Traditional Budgets Fail

Most people struggle with money because they focus on restrictions instead of possibilities. Our program teaches you to think like an investor, not a spender.

You'll learn the same frameworks that wealth advisors use with high-net-worth clients – adapted for real people with real lives and real challenges.

- Evidence-based goal setting techniques

- Behavioral psychology insights

- Practical implementation strategies

- Long-term wealth building principles

- Risk management fundamentals

What You'll Actually Learn

Real skills that make a difference in your financial life, not theoretical concepts you'll forget next week.

Foundation Building

Weeks 1-3: Understand your current financial situation and identify the psychological patterns that shape your money decisions.

- Financial self-assessment tools

- Understanding your money personality

- Identifying limiting beliefs

- Cash flow analysis techniques

Goal Architecture

Weeks 4-6: Design a financial future that excites you and create concrete steps to get there.

- SMART goals for finances

- Priority ranking systems

- Timeline development

- Risk tolerance assessment

Strategy Implementation

Weeks 7-9: Put your plans into action with practical tools and systems that actually work in busy lives.

- Automated saving strategies

- Investment basics

- Emergency fund planning

- Debt reduction frameworks

Advanced Concepts

Weeks 10-12: Explore sophisticated strategies for wealth building and long-term financial security.

- Tax optimization strategies

- Portfolio diversification

- Estate planning basics

- Continuous improvement systems

Learn From Experienced Practitioners

Our instructors have real-world experience helping people build wealth and achieve financial independence.

Marcus Donovan

Former investment banker who now helps everyday Australians build wealth. Marcus has guided over 500 families through major financial transitions and specializes in goal-based planning strategies.

Sarah Kim

Combines psychology and finance to help people overcome money blocks. Sarah's research on financial goal achievement has been featured in several Australian financial publications.

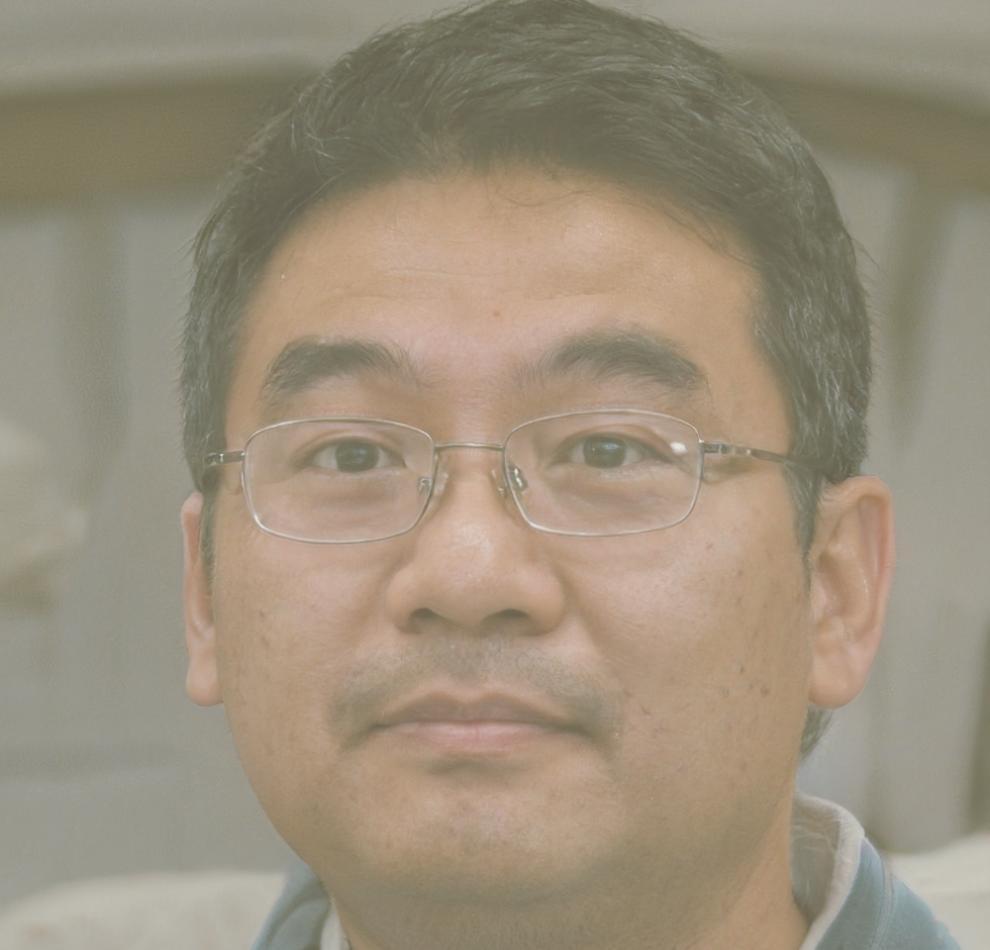

David Chen

Started with $50,000 in debt and built a seven-figure portfolio. David teaches the practical systems he used to achieve financial independence by age 35.

Emma Rodriguez

Twenty years in institutional risk management. Emma teaches how to protect your wealth while pursuing growth opportunities, focusing on sustainable long-term strategies.

Ready to Take Control?

Our next cohort begins in September 2025. Limited to 24 participants to ensure personalized attention and meaningful peer connections.